From Plastic to Paper: How Asian Countries Push for Sustainable Packaging

By: Nooraishah Omar, Editor, paperASIA

As global concerns about plastic pollution mount, countries across Asia are undergoing a significant transformation in how they approach packaging. Once heavily reliant on single-use plastics, the region is now emerging as dynamic force in the global shift toward sustainable alternatives. Governments, consumers and corporations are increasingly aligned in pushing for eco-friendly materials, driven by heightened environmental awareness, stricter regulations and the urgent need to address mounting waste. Paper and fibre-based packaging solutions, in particular, are gaining momentum as viable substitutes, offering renewable, recyclable and biodegradable options suited to Asia’s diverse economic and environmental landscape. In this article, paperASIA explores the regional efforts, policy shifts, technological innovations and persistent challenges shaping Asia’s journey from plastic to paper – and toward a more sustainable packaging future.

Consumer Awareness and Environmental Impact Drives Packaging Future

In recent years, Asia has witnessed a rapid transformation in consumer consciousness, especially in relation to sustainability and environmental responsibility. This shift is being driven largely by the expanding middle class, urbanisation and greater media coverage of plastic pollution, particularly its devastating impact on oceans and local ecosystems. These changes are now directly influencing packaging choices across the region.

According to Statista Consumer Insights, 42% of grocery shoppers in Indonesia consider environmentally friendly packaging crucial when purchasing food, nearly double the global average of 22%. This trend reflects a broader change in Southeast Asian urban centres, where rising education levels and digital access have helped elevate environmental awareness.

Cities like Jakarta, Manila, Bangkok, Ho Chi Minh City and Kuala Lumpur are now at the forefront of this change. These major metropolitan hubs are increasingly becoming testing grounds for sustainable packaging models, as both multinational and local brands experiment with biodegradable, compostable and reusable materials. These cities not only influence rural consumption trends but also serve as regional innovation hubs, positioning Southeast Asia as potential leader in the global shift towards sustainable packaging.

Asia is also ground zero for the world’s plastic pollution crises. The region accounts for a significant portion of global marine plastic waste, largely due to inefficient or underfunded waste management systems, over-reliance on single-use plastics, limited recycling infrastructure and rapid population growth and urban sprawl. This sparks both public outrage and government action, pushing policymakers to explore bans on certain plastics, impose extended producer responsibility (EPR) schemes and offer incentives for sustainable alternatives. This shift has prompted major Fast Moving Consumer Goods (FMCG) and retail brands to rethink their packaging portfolios, piloting eco-friendly models across these urban markets.

Regulatory Drivers Accelerate Shift Away from Plastics

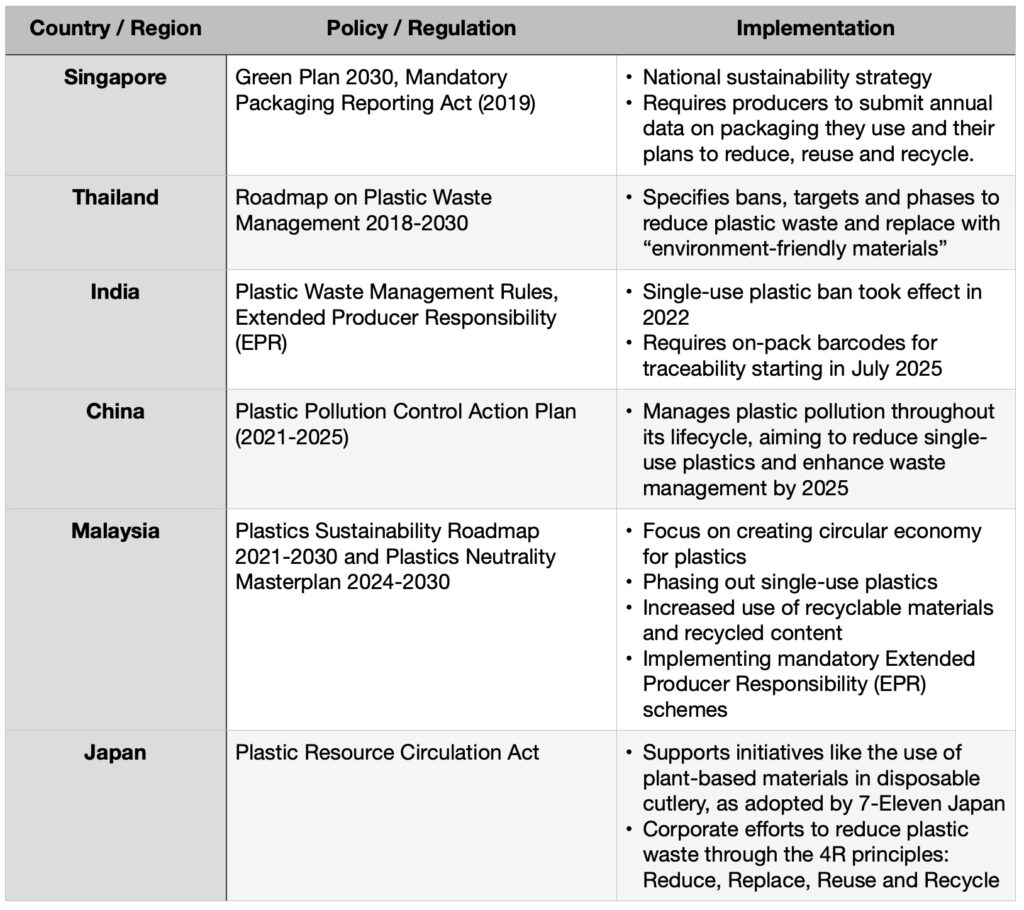

Governments in Asia are enacting powerful legislation to control plastic waste and promote sustainable alternatives like paper. Countries such as Thailand, Malaysia and Vietnam have enacted bans or tighter restrictions on plastic waste imports, which were previously directed to the region after China’s ban in 2018. This forces countries to manage their own domestic waste and reduce reliance on external processing.

Many Asian nations are also adopting the Extended Producer Responsibility (EPR) frameworks, which require manufacturers to be financially or physically responsible for the entire lifecycle of their packaging. Malaysia has a draft EPR scheme planned to be mandatory by 2026. Meanwhile, Thailand’s Sustainability Packaging Management Act established an EPR framework starting 2025 and, Japan and South Korea have established EPR schemes for various product groups, compelling manufacturers to design more recyclable products.

The outright banning of specific single-use plastics is common across Asia. In China, a five-year plan was announced in 2021 to phase out non-degradable plastic bags and other items in major cities, while Thailand has established a roadmap that includes bans on single-use plastic bags, cups and straws. Singapore’s Mandatory Packaging Reporting (MPR) scheme holds companies accountable for the waste they produce. The companies are required to submit annual reports on packaging imported or used in the country and a 3R (Reduce, Reuse, Recycle) plan. The data collected will help shape future waste management policies in the country.

Comparative insights from various policy approaches to reducing plastic use highlight several key lessons. Setting clear, phased timelines—such as targets for 2025, 2029 and 2030—allows both industry and consumers to adapt gradually to new regulations. A diverse policy mix, including bans, Extended Producer Responsibility (EPR) laws, import restrictions and public awareness campaigns, proves more effective than relying on any single measure. Often, local and regional governments take the lead—such as Jakarta and Penang—acting as testing grounds or models for national implementation. Ultimately, shifts in consumer behavior and industry-driven innovation are critical in making these transitions viable and effective.

Apart from governments’ role in promoting sustainable alternative, major multinational and regional corporations are committing to ambitious sustainability goals, which accelerates the shift away from plastic. Corporations such as Nestlé, Kao Corporation (Japan) and Watsons have pledged 100% reusable or recyclable packaging and net zero plastic footprints, along side in-store recycling programmes across Asia.

Key Challenges of Alternative Sustainable Packaging

Despite the progress, Asian countries face several hurdles in the transition to sustainable packaging. Challenges in adopting alternative sustainable packaging include high costs, limited raw material availability, complex manufacturing processes, underdeveloped recycling infrastructure, regulatory uncertainty and potential performance issues such as reduced shelf life or barrier properties. Additionally, consumer perception, the need for behavioural changes regarding waste and reusable options, lack of clear labelling and navigating varying regulations and supply chain transparency further complicate the adoption.

High production costs attributed to the transition to sustainable packaging are particularly burdensome for small and medium enterprises (SMEs) and industries operating on thin profit margins. While Asia is a manufacturing powerhouse, facilities capable of producing eco-friendly packaging materials, such as bioplastics, compostable films or recycled paper composites, are still relatively scarce or underdeveloped in many parts of the region. Setting up new production lines incurs high initial investment costs for manufacturers and reliance on imports of sustainable raw materials further increase costs due to tariffs, shipping and currency fluctuations. While there is increasing awareness on sustainable packaging in the region, there is still a lack of economies of scale, as demand for such materials is still growing and inconsistent.

Developing sustainable packaging often requires significant research and development, along with the adoption of new technologies and manufacturing processes. R&D investment is still limited, especially among SMEs and access to foreign technologies and patents comes at a high cost. As a result, businesses may hesitate to shift to greener alternatives due to the financial risks associated with uncertain returns on these investments.

While some Asian governments are introducing regulations to promote sustainability, many still lack clear standards or enforcement mechanisms for sustainable packaging. There are also limited financial incentives, such as tax breaks or subsidies, to offset the higher costs of productions. The region also needs coordinated public-private support mechanisms to propel sustainability transitions in the region.

High production costs means premium-priced products. In many Asian countries, especially emerging markets like Bangladesh, Vietnam and the Philippines, the majority of consumers are extremely price-sensitive. This puts pressure on businesses to keep packaging costs low to remain competitive, making sustainable packaging less viable unless there is government support or strong demand for eco-friendly products.

While Asia has a strong manufacturing base, the economic realities, infrastructure limitations and market conditions in many countries make the cost of developing and producing sustainable packaging significantly higher than traditional alternatives. Policy intervention, capacity building and regional collaboration will be critical to reducing production costs and making sustainable packaging more accessible across Asia.

Paper and Fibre-based Innovations in Asia

As the global demand for plastic alternatives intensifies, Asia’s packaging industry is accelerating its transition toward more sustainable, bio-based materials. Among the most promising solutions are paper and fibre-based innovations, which leverage both traditional materials and new technologies to create packaging that is renewable, biodegradable and recyclable. These innovations are gaining particular traction in Asia, where governments and consumers alike are pushing for eco-friendly alternatives amid escalating plastic pollution challenges.

Historically, paper packaging has been limited in its applications due to poor water resistance and barrier properties, especially for food, beverage and personal care products. However, companies across Asia are now developing next-generation barrier coatings that improve paper’s performance without compromising recyclability. Water-based coatings replace traditional plastic or wax linings and are designed to provide resistance against moisture, grease and oxygen, key factors for preserving product integrity. Unlike plastic-laminated paper, these coatings allow the entire packaging to be proceeded in standard paper recycling streams. In South Korea and Japan, packaging companies are investing in R&D for coating technologies that support their governments’ strict recycling and circular economy policies. This innovation in enabling paper to enter sectors previously dominated by multi-layer plastic films.

Asia is also home to rich agricultural resources, which are now being tapped to create fibre-based packaging from non-wood plant sources. These materials not only offer an alternative to plastics but also add value to agricultural waste streams. Malaysian startups and R&D centres are developing flexible packaging materials using sugarcane bagasse, bamboo, palm waste and pineapple leaves. These fibres are processed into pulp to create trays, pouches and films for food and consumer goods packaging. These innovations reduce dependence on virgin plastic and utilise locally available biomass. Long know for its minimalist and waste-reducing design principles, Japan is pioneering zero-waste fibre packaging, such as molded pulp trays and biodegradable wrapping made from washi paper or plant fibres. These solutions are aligned with the country’s Basic Act for Establishing a Sound Material-cycle Society, which promote low-waste design and recycling. Thailand and Vietnam are also emerging as hotspots for plant-based fibre innovation, often ties to large agro-industrial sectors like rice, sugar and coconut processing. These localised fibre innovations also reduce the carbon footprint by shortening supply chain and reducing import dependence for raw packaging materials.

The use of 100% recycled paper is also gaining momentum in Asia as both practical and scalable solution for reducing landfill waste and closing material loops. Sonoco Asia, one of the leaders in fibre-based packaging, produces paper cans, tubes and cores using 100% recycled fibre, catering to markets like snacks, beverages and cosmetics. These products are lightweight, customisable and increasingly preferred by eco-conscious brands.

Other regional manufacturers in India, China and the Philippines are also increasing their capacity to produce recycled-content packaging, especially for e-commerce and retail applications. India’s paperboard sector is innovating with Kraft paper alternatives and corrugated fiberboard using high-recycled content, while China, in response to its nations “waste ban” policy, is investing heavily in domestic recycling systems to support paper-based packaging industries.

Asia’s push toward paper and fibre-based packaging reflects a larger movement to redefine sustainability in terms that align with there region’s resources, economic development and environmental challenges. By leveraging its agricultural base, industrial scale and innovative capacity, the region is poised to lead in the development and adoption of fibre-based packaging solutions that are renewable, scalable and regionally relevant.

Asia stands at a critical juncture in the global movement for sustainable packaging. With rising consumer demand, ambitious regulatory frameworks and growing investment on innovation, the region is making bold strides in reducing its reliance on single-use plastics. Paper and fibre-based solutions, once limited by performance and scalability, are now being reimagined through local innovation and advanced technologies. Yet, significant challenges remain. High production costs, limited recycling infrastructure and regulatory inconsistencies continue to hinder widespread adoption, especially among small and medium-sized enterprises. To truly unlock the potential of sustainable packaging, Asia will need coordinated policy support, industry collaboration and regional investment in infrastructure and R&D. If these hurdles are addressed effectively, Asai not only has the capacity to meet its sustainability goals but also to lead the world in redefining the future packaging, rooted in circularity, innovation and environmental responsibility.